Top Real Estate Tax Software Solutions for Property Owners

Controlling real-estate fees can frequently feel overwhelming, with complicated calculations, shifting regulations, and the regular pressure to decrease liabilities. But in the present digital age , real estate tax computer software is emerging as a robust tool to help house homeowners, investors, and corporations streamline real estate tax software while keeping money.

Why Real Estate Tax Software is a Game-Changer

Recent data highlight the significant financial advantages of leveraging advanced technology for tax management. Based on surveys, organizations that undertake computerized tax answers report up to 20% reduction in planning and filing errors. These problems not only cost time but usually lead to penalties that might have been avoided. By reducing guide procedures and human mistakes, real estate tax pc software ensures greater accuracy and compliance.

Furthermore, property homeowners can optimize deductions and find overlooked possibilities for savings. Several systems now use sophisticated algorithms to quickly recognize and label deductible expenses, such as depreciation, maintenance charges, and curiosity payments. With tax auditors citing imperfect or inaccurate deductions among the top factors for audits, the ability to enhance precision becomes invaluable.

Key Benefits of Using Real Estate Tax Software

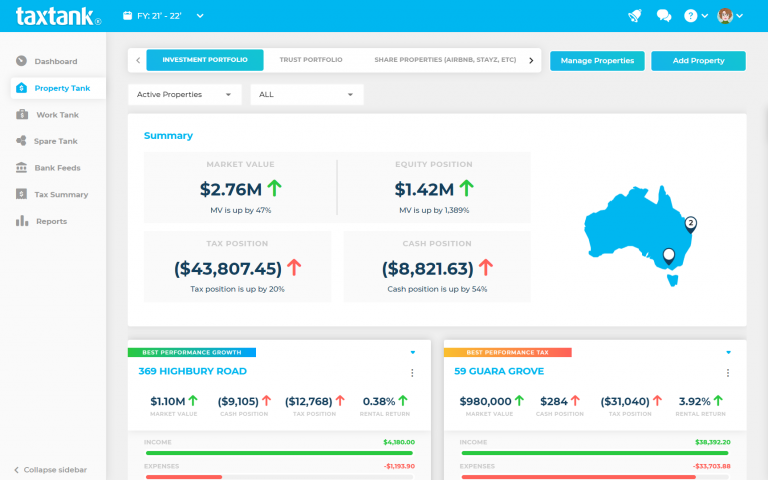

One of the many remarkable options that come with modern tax software is its power to integrate with present systems. Whether managing multiple homes or even a simple hire device, customers can simply monitor revenue, costs, and tax liabilities in real-time. Automated reporting functions further encourage people by giving apparent ideas to their tax situation, enabling proactive planning in front of tax season.

Still another important advantage is remaining up-to-date with shifting tax regulations. Laws encompassing real estate taxes are continually developing, and missing key updates can cause expensive compliance issues. Tax software vendors usually update their programs immediately to reflect the latest principles and duty limitations, ensuring that customers remain educated and compliant.

Concurrently, in regards to audits, having organized and easy to get at paperwork is crucial. Property tax application assists maintain centralized documents, reducing the severe last-minute struggle for bills or documentation.

Take Control of Your Tax Strategy

Real estate tax application provides a lot more than comfort; it offers people a substantial side in optimizing savings, raising compliance, and simplifying the frustrating task of tax management. By adopting that cutting-edge technology, home owners and corporations can concentrate on development while leaving the burden of calculations and submission to a reliable, computerized system.

Comments

Post a Comment